Cash rounding adjusts the total amount payable in cash transactions to the nearest rounding interval based on a selected rounding rule. It does not affect transactions made via card, mobile payments, or other non-cash methods.

Cash rounding is useful in:

- Countries where small coins have been removed from circulation.

- Situations where merchants want to minimize handling of small change.

- Cases where rounding is legally or optionally permitted.

Note: Rounding does not impact taxes or how they are calculated.

How to Set Up Cash Rounding

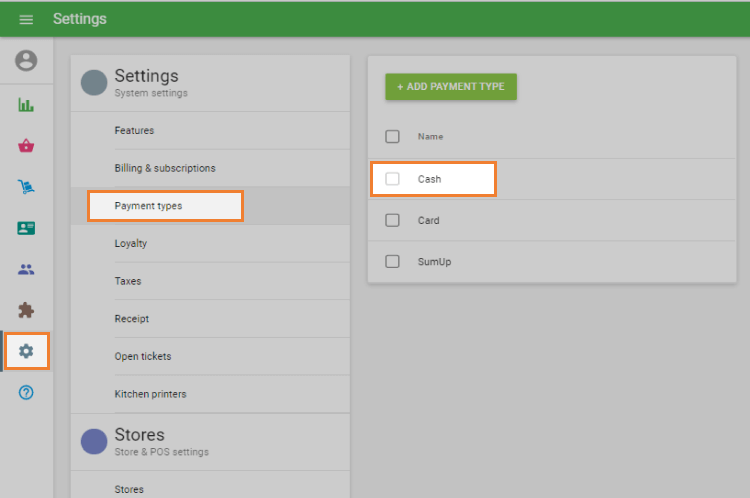

Log in to the Back Office.

Go to Settings > Payment Types.

Click on the Cash payment type to edit it.

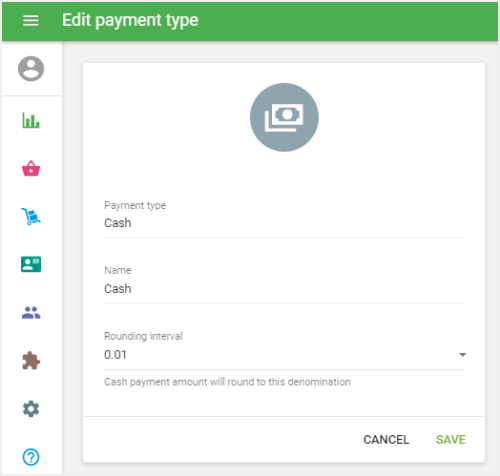

Configure Rounding Settings:

In the Edit payment type window, choose your preferred rounding interval from the drop-down list:

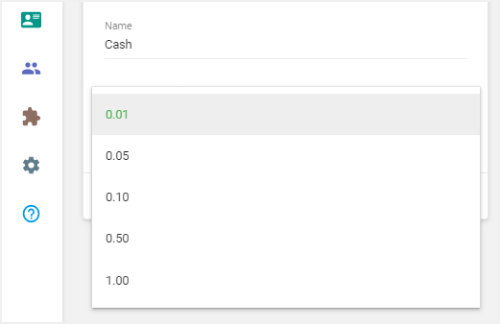

For currencies with decimals:

- 0.01 (default)

- 0.05

- 0.10

- 0.50

- 1.00

For currencies without decimals:

- 1 (default)

- 5

- 10

- 50

- 100

If the default interval (0.01 or 1) is selected, rounding rules are not available because no rounding will be applied.

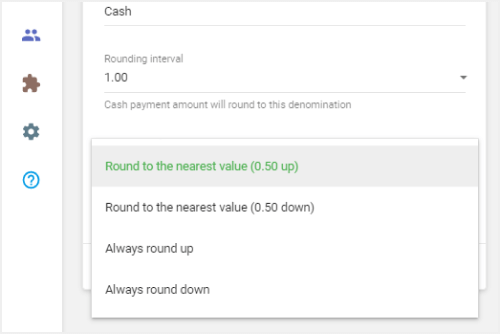

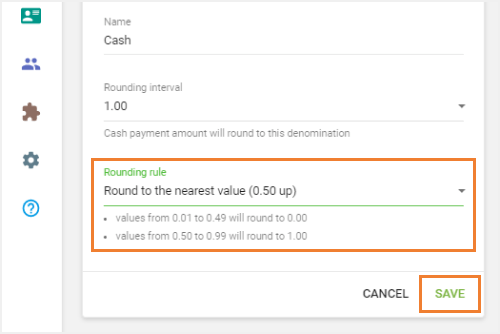

Choose a Rounding Rule:

When a custom interval is selected, you can choose one of the following rounding rules:

- Round to the nearest value (average value up) – default

- Round to the nearest value (average value down)

- Always round up

- Always round down

A short explanation will appear to show how the selected rule works.

Don’t forget to Save the changes.

How Cash Rounding Works at the POS

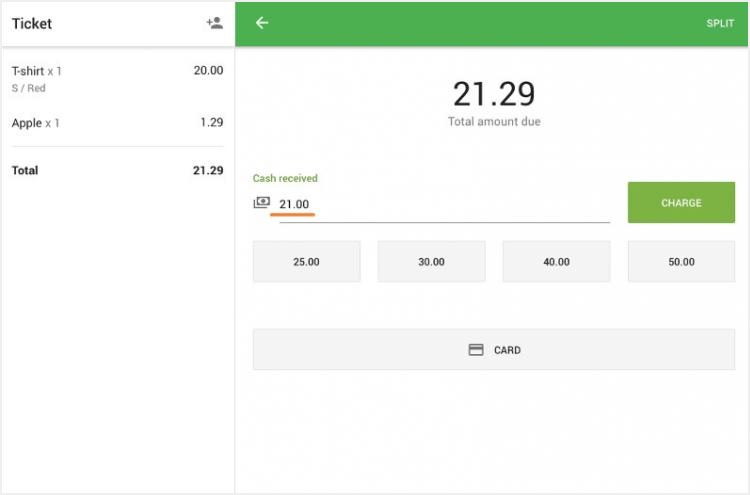

When cash rounding is enabled:

At the sale screen, once you select Cash as the payment method, the total amount will be rounded according to the rules you've set.

- In the ‘Cash received’ field, you will see the rounded total.

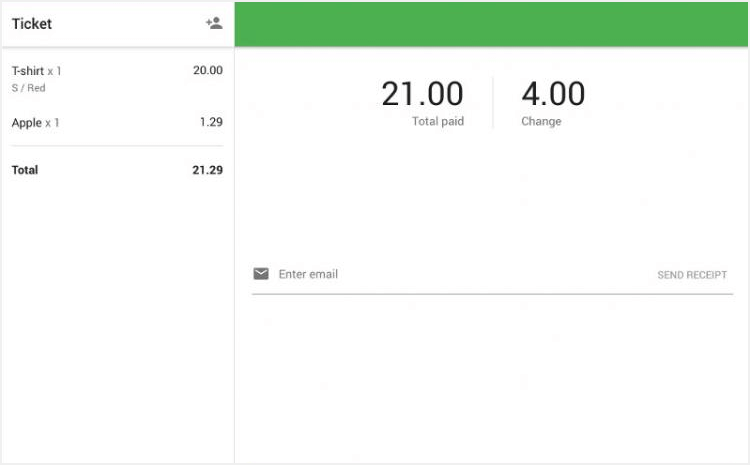

- After you enter the amount of cash received and tap ‘Charge’, the change due will be calculated based on the rounded total.

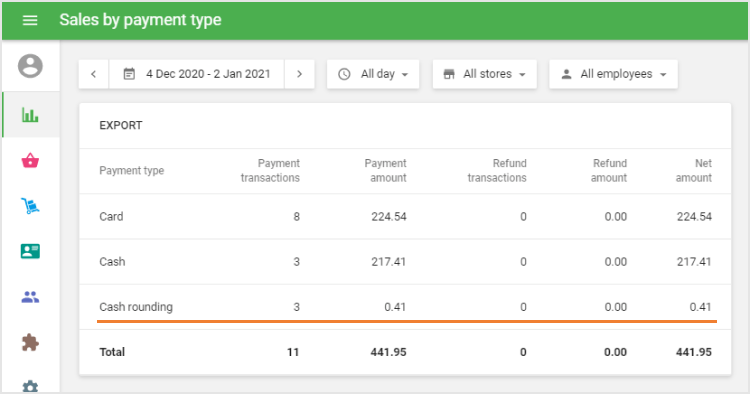

Where You Can See Rounding Information

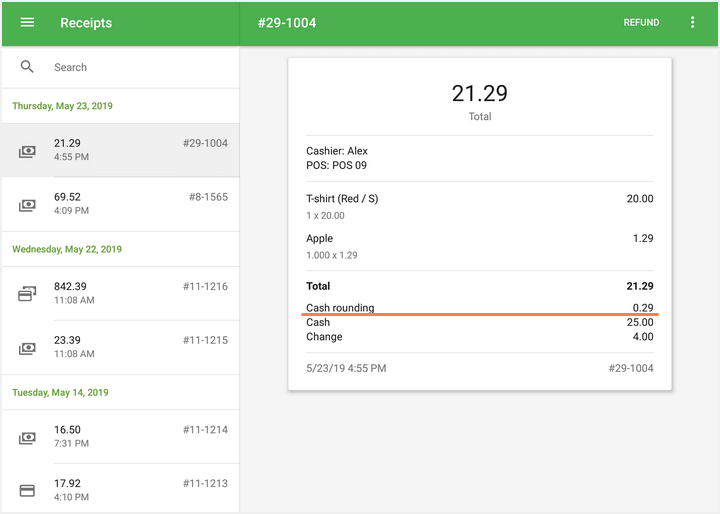

Receipts will clearly show the rounding adjustment.

- In the Back Office, you can view rounding amounts in the Sales by Payment Type report.