In some countries, the tax on certain goods depends on the dining options. For example, if the customer orders food for takeout, it is not taxed. But in the case of consuming the same food inside the cafe, it is taxed.

Please be sure that the Dining Options is activated in the Back Office.

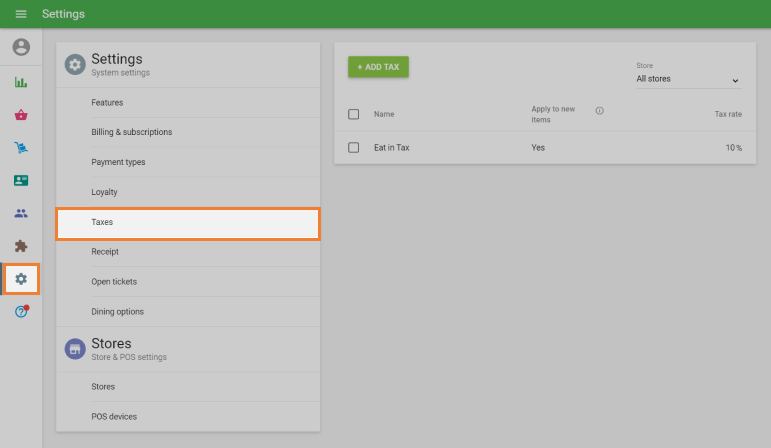

Go to the ‘Taxes’ section in the ‘Settings’ in the Back Office. Open the existing tax to edit or create a new one.

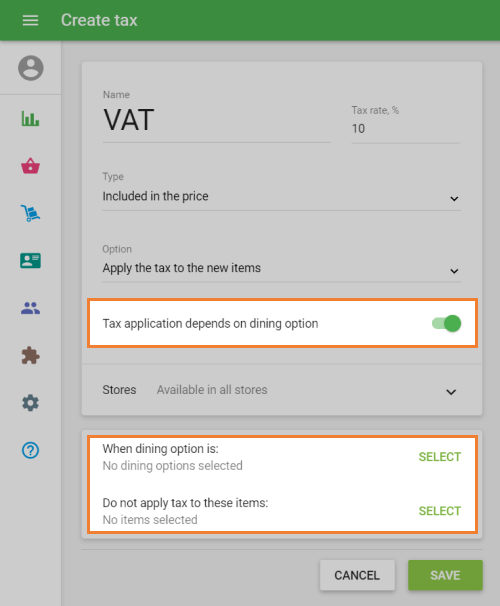

Switch on the ‘Tax application depends on dining option’.

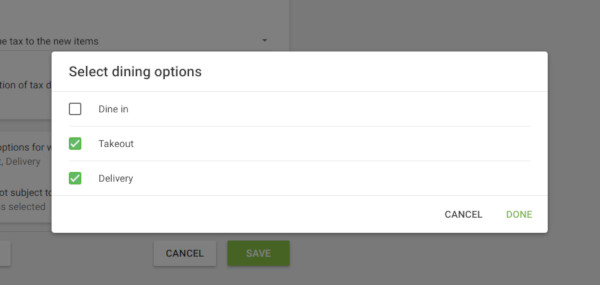

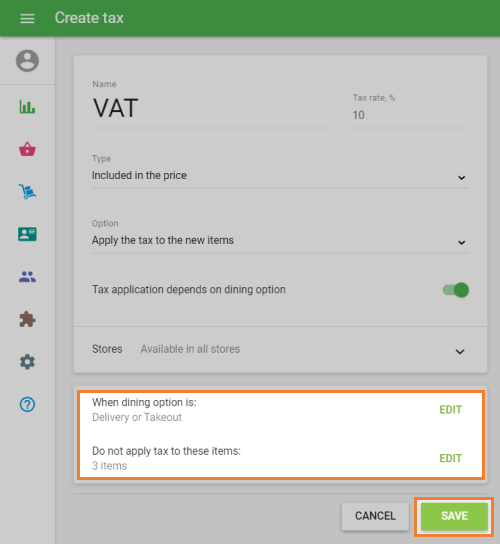

Click on the ‘Select’ button to choose the dining option for which an exemption of the tax applies.

For example, if you want your tax to apply only for ‘Dine in’, select all other options: ‘Takeout’ and ‘Delivery’.

Don't forget to save your settings by clicking ‘Done’.

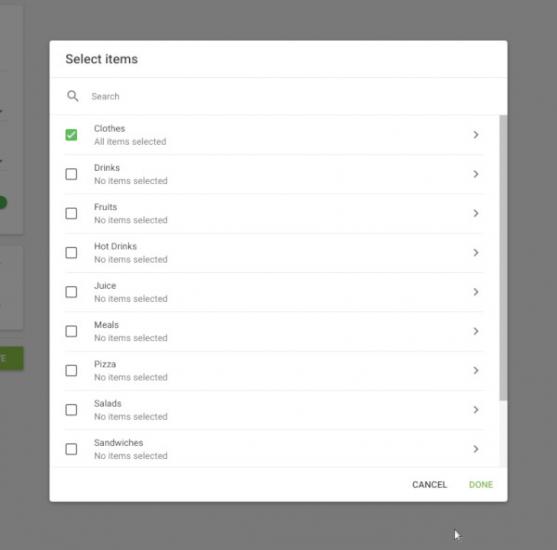

Click on the ‘Select’ button to choose items not subject to tax.

You can select the whole category or certain items that are excluded from tax.

Don't forget to save your settings by clicking ‘Done’.

After you have set the exceptions for the application of your tax, you will see their short description. You can edit them or save changes.

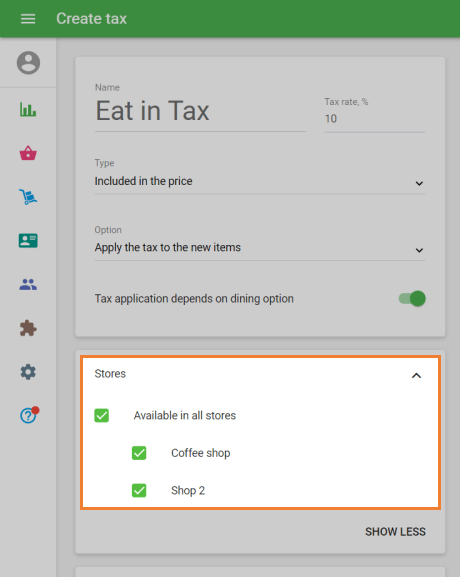

If you have several stores, you can select the availability of the tax for each store.

You will also see the information about the applied dining option in the item edit card.

During a sale, the system removes the tax from items in the ticket to which it should not be applied according to the settings and exceptions made for the dining option so that the cashier does not need to remove it manually.

Note: the cashier can also change the application of the tax to the item manually during the sale, but this change would be applied only to the items in the current ticket.

See also: